US cases are at 65,652, up from 52,900 yesterday. New York continues to make up about half of those cases.

Tennessee is up to 784 cases from 667 yesterday. Knox county officially moved up to 20 from 13. We continue to expect that the real number is higher.

We don’t have much to say today, so we won’t say much. So far, the cases are doing what the models suggest, going up exponentially.

Where are things today?

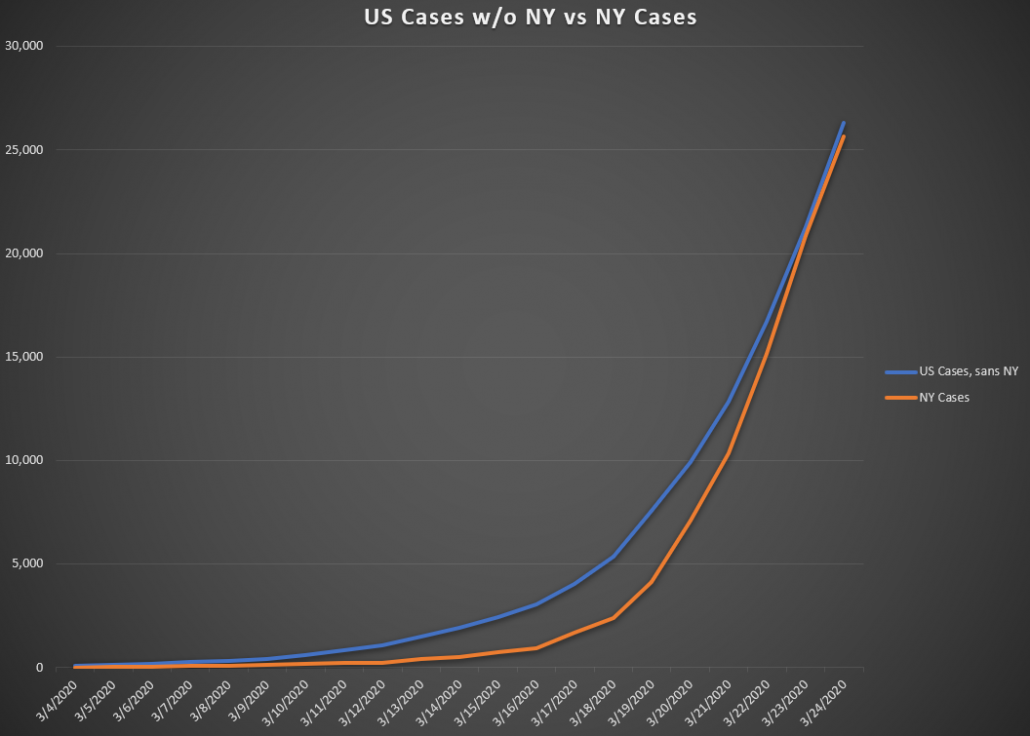

We doubt that it is news by today, but cases are up everywhere. Comparing NY to all the other states and territories, except New York is interesting:

The US as a whole follows a fairly steady curve, whereas you can see when New York starts to accelerate. On the one hand, great news, NY is driving this whole thing. On the other hand, this curve still leaves out of hospital and ICU beds inside of 7 to 10 days. It’s got to get significantly less steep to avoid that scenario.

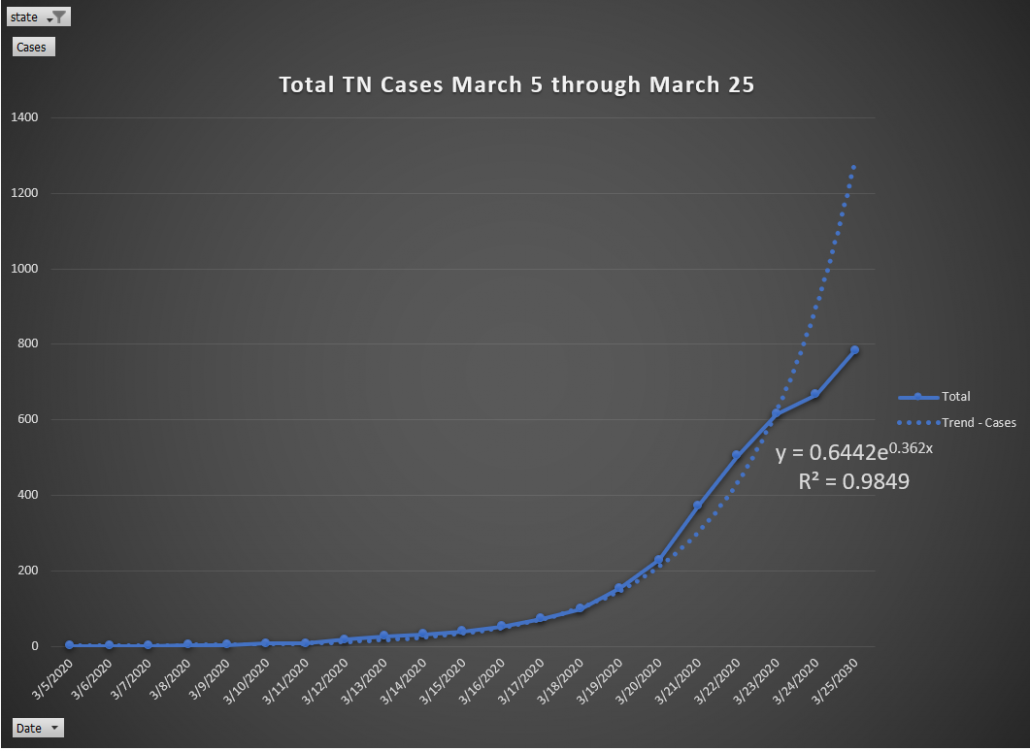

How is Tennessee today?

Less flat than yesterday. The Department of Health has actually been actively lowering expectations, letting the public know that they still expect cases to increase. Total tests are still somewhere around 11,000, which amounts to about 1/7th of 1% of the population.

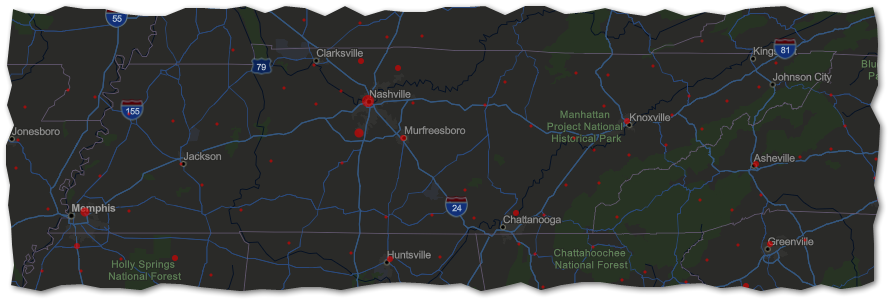

Here is a snapshot of how TN is shaping up geographically:

The thing you notice right away is that denser populations have higher cases, which isn’t a surprise in and of itself. The issue that is less obvious is that cases spread faster, faster in more densely populated areas. Also, this map appears to use the county center as the place to put the circle: the cases are not perfectly spaced apart.

International

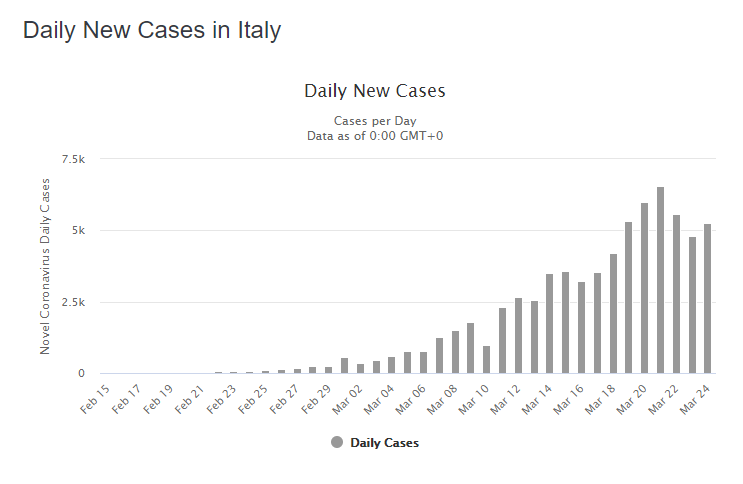

Italy continues to be down from its peak, today’s data will probably end up close to the 24th:

This is what we hope to see if social distancing and lockdowns are indeed effective.

SBA Loans

The advice we’ve gotten both from the local SBA office and a reputable firm that specializes in SBA loans is to apply for both the disaster relief (EIDL) and a traditional SBA loan. Then see what comes back faster and take that. The SBA said that that the EIDLs are 2-3 weeks plus another 7 to 10 days to process. The local SBA also said that we were ahead of the curve and that they expect this time to increase as we get further into this.

It sounds like loans are broken out in tiers from $0 – $350,000, $350,000 – $1,000,000 and over $1,000,000. Online research says that over $350,000 typically requires some level of security.

Of course, the current bailout making its way through Congress may offer additional relief. Our view is that we’re not locked out of anything until we take a loan, however, waiting to apply could effectively close that door due simply to timing.

Other Headlines

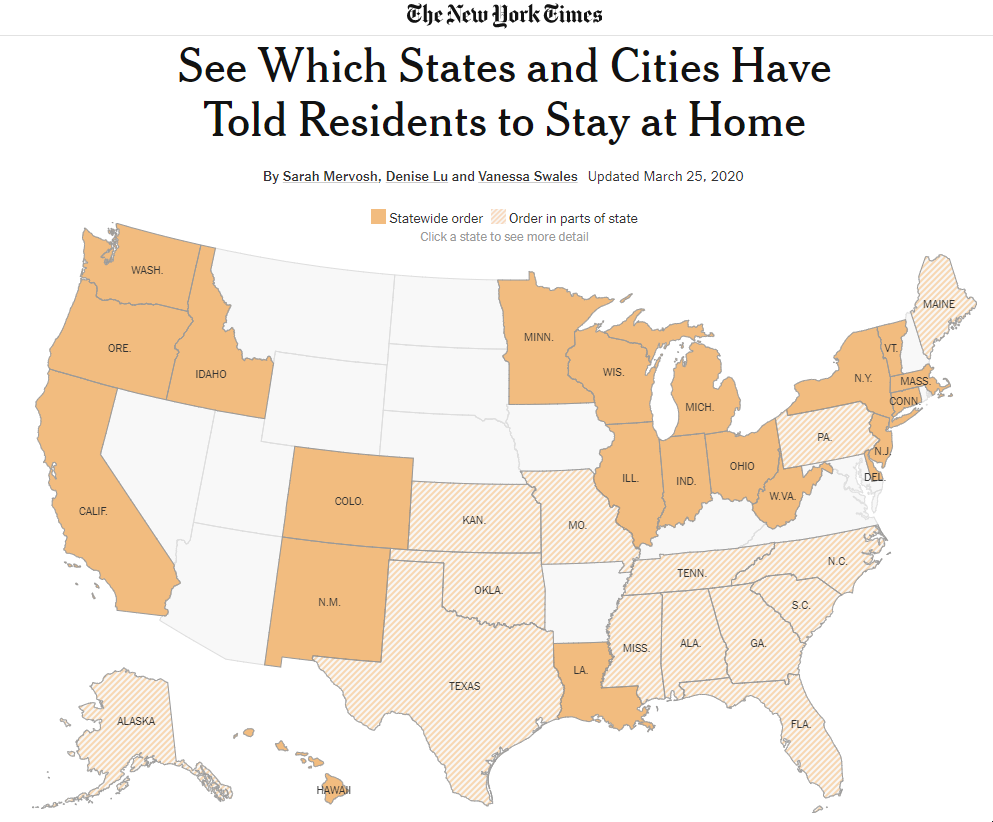

The big banks in California have agreed to a 90-day mortgage grace period. We believe that is incredibly significant and expect other states to soon follow suit in the same way they have issued stay-at-home orders.

More states are shutdown:

How We Are Adjusting

Our time horizon is still floating at 6 to 10 weeks out (so, late May at latest for the end to mass shutdowns). We’re beginning to feel that ten weeks may be optimistic based on the slow measures taken by the majority of the country.

Our biggest adjustments ahead will depend on where we believe cash will be in 4-5 weeks. We don’t believe we will have adequate visibility into late April until later this week.

Download our Report!

Get your copy of What Every Business Owner Must Know About Hiring an Honest, Competent, Responsive, and Fairly-Priced Computer Consultant.